Black-Scholes formula… maybe not as important and well-known as compounding interest-rate but still the most famous formula among options traders. Here are the formulas that you will find in financial books.

Intuition

\[ d1 = \frac{\ln{\frac{\textcolor{blue}{S}}{\textcolor{cyan}{K}}} + (r + \frac{\textcolor{lime}{\sigma}^2}{2}) * \textcolor{magenta}{t}}{\textcolor{lime}{\sigma}*\sqrt{\textcolor{magenta}{t}}} \\ d2 = \frac{\ln{\frac{\textcolor{blue}{S}}{\textcolor{cyan}{K}}} + (r - \frac{\textcolor{lime}{\sigma}^2}{2}) * \textcolor{magenta}{t}}{\textcolor{lime}{\sigma}*\sqrt{\textcolor{magenta}{t}}} \]

\[ \textcolor{green} {C} = N(d1) * \textcolor{blue}{S} - N(d2) * \textcolor{cyan}{K} * e^{-r*\textcolor{magenta}{t}} \]

\[ \textcolor{red} {P} = N(-d2) * \textcolor{cyan}{K} * e^{-r*\textcolor{magenta}{t}} - N(-d1) * \textcolor{blue}{S} \]

where:

- C - price of an European Call options

- P - price of an European Put options

- N - cumulative distribution function (CDF)

- S - Spot price of the underlying asset

- K - striKe price of option

- t - time to expiraTion (in years)

- σ - sigma - standard deviation of log returns (volatility)

- σ² - squared deviation (variance)

Scary? not really… let's put d1 and d2 terms aside for now and try to understand the call/put price formulas.

We know the discounted interest-rate formula, details and proof in this blog post.

\[ \color{blue} D = C * e^{-r*t} \]

where

- C - the compounding value (forward/future price) after t time and D is present value (current price); or put the it other way around, D is the discounted value of C.

- D - present value (discounted value) of the strike price K

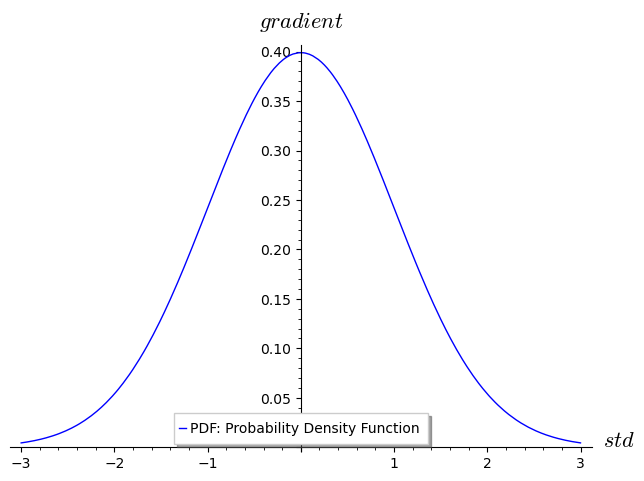

What about N( ) thing? First thing first, let's have a look at Gaussian distribution (also called normal distribution) with 1 standard deviation (σ = 1) and 0 mean (μ = 0)

G = RealDistribution('gaussian', 1) PDF = lambda x: G.distribution_function(x)

plot(PDF, (x, -3, 3), legend_label='PDF: Probability Density Function', axes_labels=['$std$', '$gradient$'])

Since PDF is probability density function we are dealing with areas of probabilities, in simple terms, the area to the left of the mean has 50% probability.

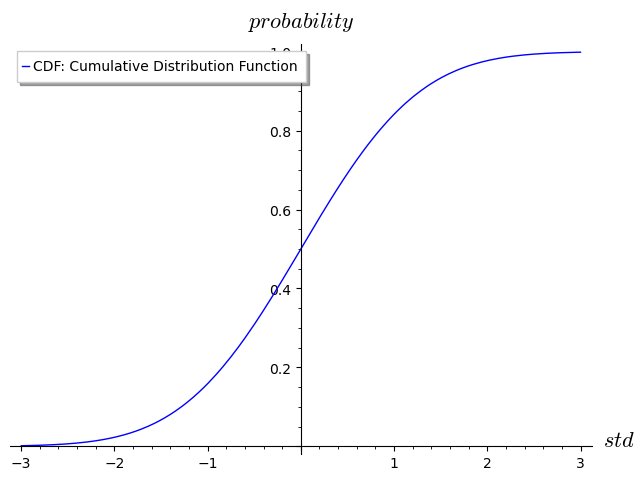

CDF = lambda x: G.cum_distribution_function(x)

plot(CDF, (x, -3, 3), legend_label='CDF: Cumulative Distribution Function', axes_labels=['$std$', '$probability$'])

CDF is called cumulative distribution function which is the probability of a random variable X to be less than a given point x.

Without going into details, the relation between the two is that, we can integrate the density function and find the cumulative function

\[ \int_{-\infty}^x PDF(x) \, \mathrm{d}x = CDF(x) \]

and vice-versa, we differentiate the cumulative function and find the density function.

\[ \frac{\mathrm{d} \, CDF(x)}{\mathrm{d}x} = PDF(x) \]

Finally, since our N( ) function is a CDF it means that it is 0 < N( ) < 1, in other words it is a weight (a scaling factor).

With this new knowledge, let's change the call/put price formulas to:

\[ \textcolor{green} {C} = N(d1) * \textcolor{blue}{S} - N(d2) * \textcolor{cyan}{D} \]

\[ \textcolor{red} {P} = N(-d2) * \textcolor{cyan}{D} - N(-d1) * \textcolor{blue}{S} \]

In conclusion:

the price for a CALL option can be viewed as:

- profit/loss amount: a scaling factor times the underlying price at expiry

- minus

- amount that we pay: scaling factor times discounted value of the strike price now

and a PUT options as:

- amount that we pay - scaling factor times discounted value of the strike price now

- minus

- profit/loss amount - scaling factor times the underlying spot price at expiration

Implementation

In Python/Sagemath it looks like this:

from math import log, sqrt, pi, exp

def d1(s, k, t, r, iv):

return(log(s/k) + (r+iv**2/2)*t) / iv*sqrt(t)

def d2(s, k, t, r, iv):

return d1(s,k,t,r,iv) - iv*sqrt(t)

def D(k, r, t):

return k * exp(-r*t)

def N(d):

return CDF(d)

def call_price(s, k, t, r, iv):

return N(d1(s,k,t,r,iv)) * s - N(d2(s,k,t,r,iv)) * D(k,r,t)

def put_price(s, k, t, r, iv):

return N(-d2(s,k,t,r,iv)) * D(k,r,t) - N(-d1(s,k,t,r,iv)) * sCall price:

s = 1330

k = 1280

t = (10 + 17/24) / 365

r = 0.01

iv = 1.34

print(call_price(s, k, t, r, iv))141.6089647684081

Put price:

s = 33760

k = 34000

t = (10 + 17/24) / 365

r = 0.01

iv = 1.10

print(put_price(s, k, t, r, iv))2655.0941969718187

Implied volatility

We can do it the other way around as well and recursively find the implied volatility for a given price.

Call IV:

def call_iv(p, iv=1.30, step=0.01):

ip = call_price(s, k, t, r, iv)

if ip > p:

return iv;

else:

return call_iv(p, iv + step)

print(call_iv(141))1.34000000000000

Put IV:

def put_iv(p, iv=1.00, step=0.01):

ip = put_price(s, k, t, r, iv)

if ip > p:

return iv;

else:

return put_iv(p, iv + step)

print(put_iv(2660))1.11000000000000

References

- https://www.investopedia.com/terms/b/blackscholes.asp

- https://en.wikipedia.org/wiki/Black-Scholes_model

- https://en.wikipedia.org/wiki/Black-Scholes_equation

- https://en.wikipedia.org/wiki/Probability_distribution

- https://en.wikipedia.org/wiki/Normal_distribution

- https://en.wikipedia.org/wiki/Standard_deviation

- https://en.wikipedia.org/wiki/Variance

- https://en.wikipedia.org/wiki/Probability_density_function

- https://www.investopedia.com/articles/investing/102014/lognormal-and-normal-distribution.asp

- https://en.wikipedia.org/wiki/Cumulative_distribution_function

- https://www.appliedaicourse.com/lecture/11/applied-machine-learning-online-course/2843/cdfcumulative-distribution-function-of-gaussiannormal-distribution/2/module-2-data-science-exploratory-data-analysis-and-data-visualization

- https://aaronschlegel.me/black-scholes-formula-python.html

- https://www.youtube.com/watch?v=YXLVjCKVP7U

- https://medium.com/cantors-paradise/the-black-scholes-formula-explained-9e05b7865d8a

- https://medium.com/swlh/calculating-option-premiums-using-the-black-scholes-model-in-python-e9ed227afbee

- https://en.wikipedia.org/wiki/Partial_differential_equation

- https://math.stackexchange.com/questions/273120/notation-for-probability-density#273141