Never ask a trader how much he makes but how much he lost… here is a story…

The beginning (2001)

My first touch with trading was in late 2001 during the Dotcom bubble when everyone wanted to get online. As part of an outsourcing company, I was assigned to work for a client that wanted to implement a Java applet to render stock charts in browser. During that 1 year project I did learn trading/investment lingo, technical indicators, linear/log chart types, candlesticks, etc but this was pretty much it.

The bug (2005)

Fast-forward to 2003/2004 when Romanian stock market was getting hot and reached a top in Jan 2005; it got my attention and somehow I started to follow the news, read investment/trading books and Investopedia articles, playing with demo accounts, etc.

The first account (2007)

But it is only mid 2007 when I opened my first real FOREX account with $1000 and I still remember my first trade: long EUR,USD,AUD against the JPY, it was just before the Great Financial crisis when every market was sky rocketing, including the FOREX market.

The reload (2009)

Of course I blew that account pretty fast (in less than 1 year or so) but it was only one lost battle, not the war. I did open another Trading212 FOREX account, new Tradeville (ex. Vanguard) account to invest in Romanian market, deposit $1k in each, then went deep down the rabbit hole. This is the time when I read lots of trading/investment books, traded any financial instruments that I could get my hands on (stocks, bonds, CFDs) and started to study derivatives products (futures, options) for the very first time.

The king of the jungle (2011)

It's mid 2011, world economy was slowly getting out of the hole but European Sovereign Debt Crisis (first in Greece then the other PIIGS countries) hit the fan with money started to flow back into safe-haven currencies mostly in USD but also in CHF/JPY.

At the end of 2011 my account was about $40k, a whopping ~40x PNL in 4 years since I started trading in 2007. Maybe it was beginner's luck, maybe market conditions but it was not bad for a software engineer without any education in financial markets.

The incoming call: Margin (2012)

I still remember that in Feb 2012 I was in Brazil for Rio Carnival and my USDRON position (the big loss ~$31k) was challenging the break-even point at 3.25 RON/USD and I had a quick thought to close it but of course I did not :).

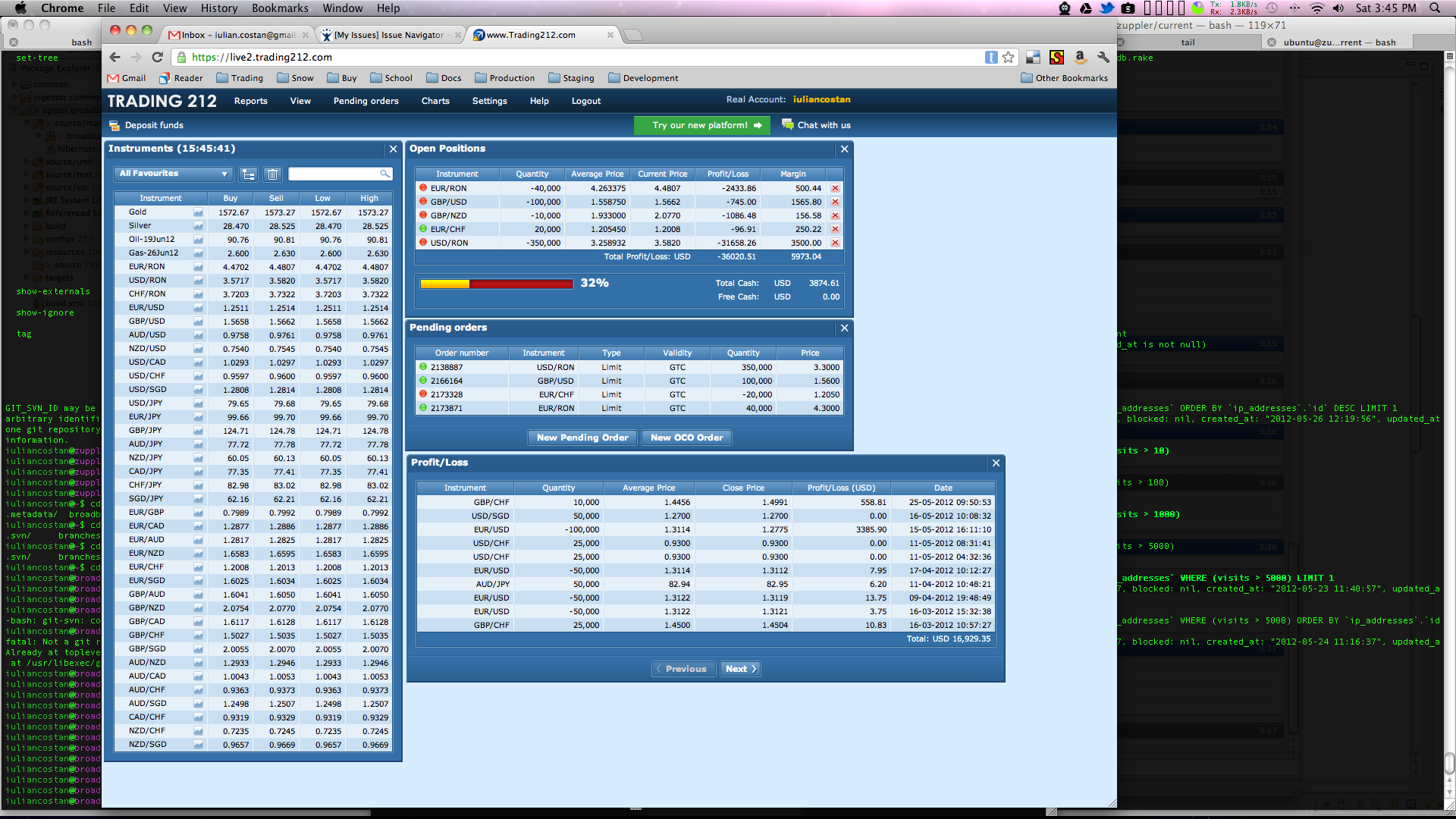

See for yourself what happened next…

…a screenshot taken on May 26th, 2012; exactly 10 years ago :).

That USDRON was a carry trade position that I did scale-in during 2009-2010 when interest-rate differential was widening; at that time big enough (~9% or something) to worth the risk of being short safe-haven currency (USD) and long emerging currency (RON). Anyway, that position was already a big winner, made quite good profit (the interest was around $30/day) and the strategy worked very well until it didn't.

Then, in the following months, USD and EUR went to the roof against emerging currencies and my account got crushed, got margin call and the rest is history.

to be continued…